January 1881 - Income tax declared unconstitutional.

August 1894 - Tariff Act creates two percent federal income tax.

1913 Was a Very Bad Year - A Package Deal

17 February - The 16th Amendment to the Constitution for the United States was declared "In effect." It was not ratified by the requisite number of States. Congress did not care, because the Constitutional requirement that Representatives and taxes be apportioned according to population had to be eliminated if a graduated income tax was to be imposed.

10 March - The Underwood Tariff Act (income tax act) was enacted to establish a tax that "gouges the rich," and threreby creates the politics of envy and unlimited demand for federal spending, which is exactly what Congress wanted.

31 May - The 17th Amendment was similarly declared "In effect" despite not being being ratified by the requisite number of states. By making federal Senators directly elected, it reduced them to being glorified Representatives, and thereby eliminated the primary impediment to federal spending: Senators elected by and from State legislators. Legislator careers were shortened by increasing State taxes to fund federal spending, so they would not re-elect Senators who voted for federal spending.

23 December - The Federal Reserve Act was enacted to provide unlimited federal funding.

1916

24 January - Tax on labor declared unconstitutional, and withheld taxes to be returned - Congress effectively ignores the Supreme Court, and the income tax continues under color of law.

If you have not read Title 26 (IRS Code), try to. Just to understand one section, you must not only read all the referenced code sections, but also read all the sections that precede each of them to learn how terms are defined in the subsequent sections. In one paragraph, "United States" is redefined three times. Even common terms like "of" are redefined. It is so tedious, that the obfucation must be intentional. It's no wonder that so many tax researchers have arrived at so many different conclusions.

Larken Rose extensively reaearched Title 26 (IRS Code) looking for the definitions of "tax payer" and "taxable income." Deep in the code he found the evidence that only foreign income earned domestically or domestic income earned by foreigners is taxable. He paid a price for challenging the omnipotent State. This is consistent with the historic proclivity of the United States to tax imports or the States rather than Americans directly. This may explain why the latest incarnation of a national income tax was enacted when the two previous attempts to impose a progressive income tax directly on Americans were declared unconstitutional. Read Kicking the Dragon or view the 861 evidence for yourself.

Another researcher, Mitch Modeleski AKA Paul Andrew Mitchell, followed the jurisdiction issue, and concluded in The Federal Zone (local PDF), that Americans were duped into being foreign to the United States as defined as Washington, D.C., the territories and federal enclaves (forts, etc.), and hence subject to the Income Tax. Some researchers advise completing a Tax Statemnet in lieu of a Form 1040 in order to avoid Federal Zone trap, which gets into the Bankruptcy declared by FDR. Then there is Jurisdiction by Oath and adhesion contracts.

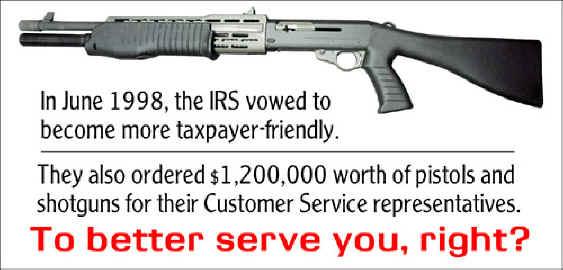

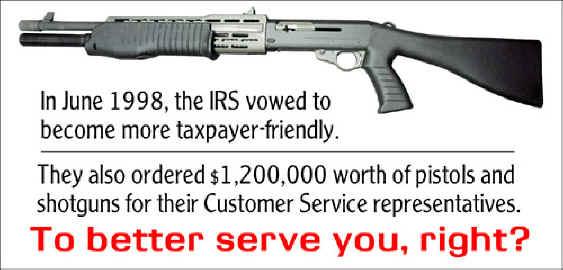

There are many theories for how a tax repeatedly declared unconstitutional could remain in effect now. It matters little which is correct, because the federal government is lawless. It wants your money, and likes having the IRS extort it from you.

7/28/1969 - While the

United States Armed Forces (private

mercenaries) are in Vietnam 'defending freedom,' the seventh circuit

court of appeals hands down United States v. Dickerson: 'Only the rare

taxpayer would be likely to know that he could refuse to produce his

records to I[nternal ]R[evenue ]S[ervice] agents.'

U.S. v. Dickerson, 413

F.2d 1111, 1116 (7th Cir. 1969).

| Home | Conditioning | Taxes |