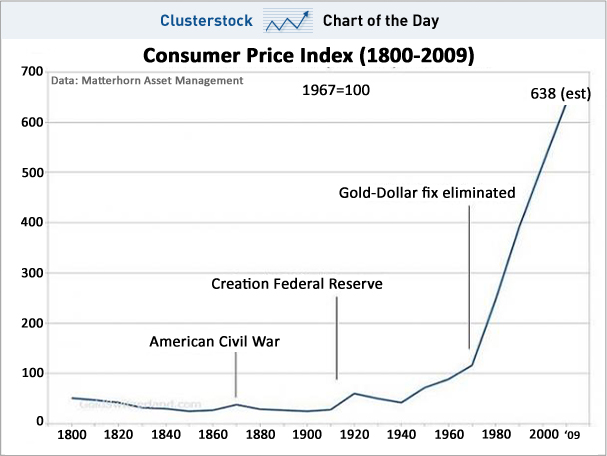

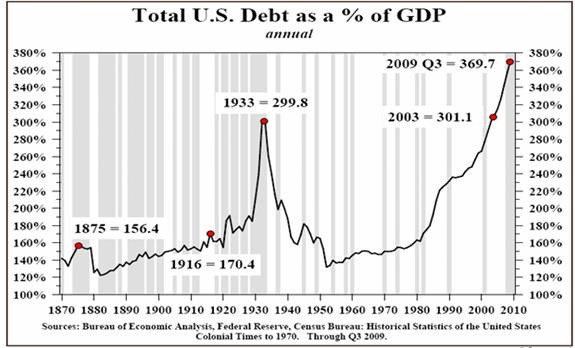

"Business cycles" are caused by credit cycles caused by central banks, like the Federal Reserve System (1). By increasing the permissible rate of loans to assets for all banks, central banks encourage lessor banks to offer cheap loans, which encourage individuals and businesses to directly invest in new homes, buildings, equipment, tools, labor or indirectly invest by way of stocks. Economic activity increases by a factor of five for each dollar loaned due to the velocity of money. The assets acquired by the loans as collateral for them increase the amount available for new loans, feeding a vicious cycle of artificial economic growth, i.e. a "bubble."

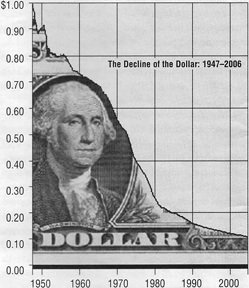

Of course, all of this credit in addition to the cash printed by the Treasury devalues the dollar.

By decreasing the fractional reserve rate, central banks discourage lessor banks from offering cheap money, and influence the interest rate on variable rate loans. Unable to sustain the earlier investment with more expensive loans, or unable to pay the more expensive interest, businesses fail, employees are laid-off, and people default on their loans, feeding a vicious cycle of artificial economic decline, asset sales and loan defaults, i.e. the bubble pops. The lessor banks foreclose and keep the payments made as well as the assets. Informed of an impending credit contraction, the friends of the central bank profit from the sale of their assets at the peak of the economic boom, and hold the cash until the bottom of the bust, so they can buy more assets for a fraction of their original value.

Since the demise of the first two National Banks, big bankers like J.P. Morgan have used this credit cycle since the mid-1800s to transfer the fruits of all untaxed productive labor of individuals to the banks and their friends. To extend and make more complete their control, a cabal of such bankers used their cycles to justify the sordid birth of the Federal Reserve System (Charles Layne) of which they are the primary shareholders and with which they have extended and completed their control of the American economy (1918 Federal Reserve Bank Statement). Similar techniques were used to install central banks in every country. The Bank of England was their progenitor.

Gold Standards and the Real Bills Doctrine in U.S. Monetary Policy is an excellent read on the origin of the Federal Reserve Bank as is The Historical Fight For Honest Money in the U.S. by Dr. Martin A. Larson.

Ludwig von Mises predicted it. Milton Freidman analyzed it. Federal Reserve Chairman Benarake admited it: "Regarding the Great Depression. You're right, we did it. We're very sorry. But thanks to you, we won't do it again." -- yeah, right.

Ron Paul discredits it in The Money Monopoly: How the Federal Reserve Rips You Off. See also "Why Does The United States Need Constitutional Money?" Six Questions On Monetary Reform by money expert Edwin Vieira, Jr.

Consequently,

speculation increased to the extent that

individuals

engaged in

Consequently,

speculation increased to the extent that

individuals

engaged in